Britain’s leading business organizations are calling on Chancellor of the Exchequer Jeremy Hunt to unveil a package of economic measures later this month that includes tax cuts, improvements to the UK’s electricity grid and policies to tackle skills shortages.

In his Autumn Statement on November 22, Hunt warned against expecting major returns, emphasizing that his main focus is on curbing inflation, which remains well above the government’s 2% target. However, industry leaders believe there is still scope for the Chancellor of the Exchequer to stimulate the business environment within these constraints.

“Shevaun Haviland, director general of the British Chambers of Commerce (BCC), said, “He has a variety of options to bring about real change without spending too much money.” Businesses tell us they have billions of pounds of private investment ready to pump into the UK economy.”

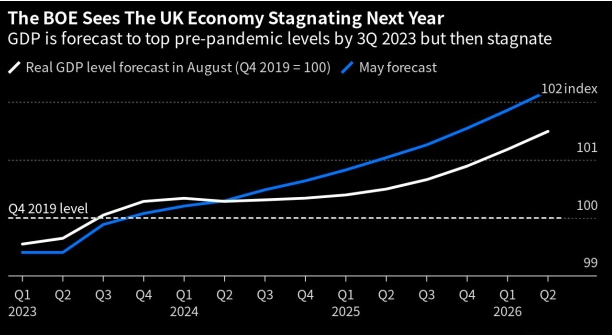

The economic outlook remains bleak, with the Bank of England recently cutting its growth forecast for 2024 to zero from 0.5 percent, suggesting a 50 percent chance of recession next year. Hunt’s last budget in March had fiscal space of 6.5 billion pounds, the lowest level on record.

Hunt faces a delicate balancing act amid calls from Conservative MPs and the ruling party for tax cuts, with the Tories trailing Labor by about 20 points in recent opinion polls, in what could be the penultimate fiscal event before next year’s general election. His dilemma is whether to prioritize voter-focused measures that would boost Conservative support in opinion polls, such as cuts to inheritance tax or stamp duty, or to support corporate tax cuts that have less public appeal but would revitalize the economy.

Britain’s so-called “Big Five” business groups – the Confederation of British Industry (CBI), the British Chambers of Commerce (BCC), MakeUK, the Institute of Directors, and the Federation of Small Businesses – all advocate the latter approach. Here are the key demands of the UK business community:

Extend investment tax credits

The industry’s top demand is for Hunt to make permanent its ‘full cost’ policy, introduced in March this year, which gives businesses until March 2026 to receive 100% tax relief on capital expenditure such as new machinery. According to the Confederation of British Industry (CBI), making the policy permanent – which Hunt has signaled his intention to do – could increase investment by around 50 billion pounds ($62 billion) a year and grow the economy by 2% by 2030/2031, if public finances allow.

Treasury officials are currently considering other options, according to people familiar with the situation, including providing capital subsidies if the full cost is deemed unaffordable.

Fixing the Grid

The BCC urges Hunt to accelerate grid upgrades through the planning system, speed up the integration of new generating capacity into the grid, and address the delays that are preventing the UK from achieving its net-zero carbon emissions target.

Mitigating the skills shortage

The tightening of the UK labor market due to the COVID-19 pandemic and Brexit is another concern for businesses. Manufacturing lobby group MakeUK has called on Hunt to allow more immigration for engineering roles to fill vacancies and to reform the apprenticeship levy to encourage more apprentices to join.

A number of business groups have also urged Hunt to provide tax relief for companies providing occupational health services to keep more people in work.

Expanding help for retail and hospitality

Both the Financial Stability Board (FSB) and the British Chambers of Commerce (BCC) have asked Hunt to extend the 75% discount retail, hospitality and leisure companies currently receive on their business rates bills, a tax based on the taxable value of their premises. The discount, which is designed to support Britain’s high streets, is due to expire next March.

Restore tax-free shopping for international visitors

The BCC has recommended that Hunter reinstate the scheme that allows non-EU shoppers to reclaim 20% Value Added Tax (VAT) on purchases, a tax break that encourages UK tourism and luxury shopping.

+ There are no comments

Add yours